Near term robust market position. Medium term growth but intense local and international competition ahead for Starbucks.

| Investment Recommendation |

| Recommendation is a HOLD for SBUX. The past performance is the company shows good potential for long term stable growth and would watch for buying opportunities if stock moves below its value target. |

- Valuation of business estimated to be $103.37B

- SBUX will enjoy excess returns in the near term. but that over the next several years local competitors in the different markets around the world will reduce return on capital.

Current Price: $70.74 / share

Revenue Growth

Operating Margin

Return on Capital

Reinvestment % EBIT(1-t)

Value Target: $65.01 / share

2.61%

16.73%

7.50%

37.18%

| Summary |

Starbucks is the market leader in specialty coffee drinks and café-style consumer experience. We forecast 7.9% annual growth over the next 10 years, with rapid growth in international stores and revenues but slowing growth in the U.S. market as the company continues to mature. We anticipate that overseas store count will eventually exceed domestic store count. Starbuck’s leading brand will create long-term excess returns, but competitive pressure from local brands will offset gains to Starbucks from digital improvements in stores, consumer loyalty programs, and new products. We anticipate these factors will keep long-term operating margins in line with current levels.

| Recommendation Drivers |

Long Term Excess Returns

Starbucks’s long-term excess returns will be driven by their competition advantages. Brand reputation, human capital, financial flexibility, data collection, consumer loyalty programs, distribution infrastructure, and scale. These factors create an expected return on capital of 19.59% into perpetuity. We anticipate this return on capital will be constant as Starbucks grows internationally. International expansion will require adapting the brand and model to new markets, rather than reinventing the brand from the ground-up.

Convergence to Industry-level Ratios

We believe Starbucks is transitioning from the mature-growth to mature-stable part of its corporate lifecycle. The Starbucks brand is nearing saturation in existing markets while company growth is expanding in new markets. Therefore, we expect that financial measurements and ratios will converge to their industry- or market-level averages over the long-term.

Market Price vs. Business Valuation Current market price is in line with our valuation analysis. This reflects the lifecycle stage of the company, and the predictability of cash flows, return on capital, growth, and risk profile.

Value of Operating Assets

+ Cash & Non-Op

= Value of Frim

– Value of Debt

= Value of Equity

– Equity Options

+ Value Investments

Value per Share

$95,168

$4,992

$100,159

$8,773

$91,387

$47

$170

$65.01

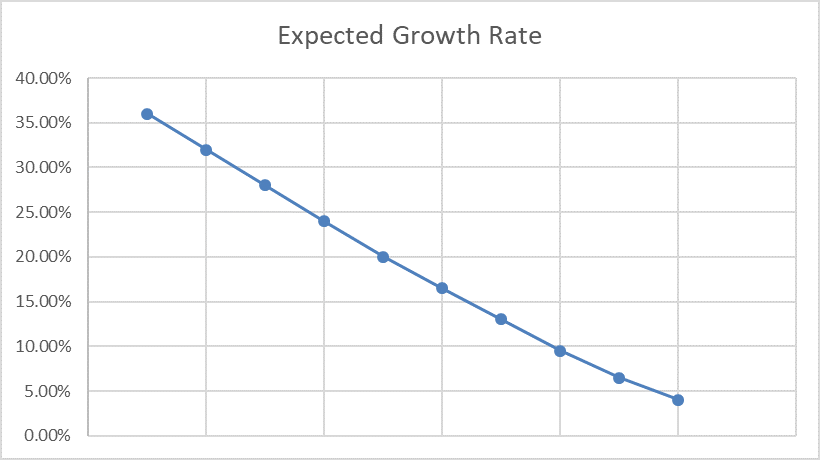

Sensitivity Analysis

We assume that over the long term, Starbucks will converge to industry levels of capital expenditures and non-cash net working capital. This assumption drives our estimation of the reinvestment rate, which drives company-level return on capital. Our estimation of the return on capital is greater than the cost of capital in perpetuity, reflecting the value that we and the market perceive in the Starbuck’s brand and other components of sustainable competitive advantage.

Damodaran Online is a recommended resource for doing similar equity valuations. Pre-built spreadsheet models can be found in the Tools -> Spreadsheets -> Valuation.

Update August 2020: This was an equities valuation practice March 2019 looking forward at revenue and cash growth based on the market conditions expected at the time. We estimated that Starbucks would show stable but limited near term growth then struggle to grow in an increasing competitors local markets. At the time the threat of large competitors like Luckin was overestimated. That was however due in part to fabricated sales numbers published by Luckin discovered in mid 2019. With that revelation Luckin went into a downward spiral which may lead to its collapse removing a strong competitor from Starbucks growth plans in China.

This valuation was also created before the world events of COVID-19. We did not consider any “black swan” world events that would significantly impact all in person consumer businesses. This demonstrates how valuations are inherently just a snapshot with the known information at the time and will need to be reconsider over time with change.

This initial recommendation was in its near term forecast. Active traders would have missed out on short term price spikes when SBUX rose to a high of $99.11 on July 26, 2019. However longer term value investors would have potentially captured the buying opportunity when the price dropped to $58.03 on March 20, 2020. Starbucks appears to have weathered the global pandemic better than its competitors with very thoughtful connecting to customers and putting public safety first. Their relative positive cash positions enabled them to sustain short term loses for the far more important long term gain to brand and customer loyalty. SBUX now trades above $77 in late August of 2020.

Recent Comments